Auditor General for Local Government

Why and when the office of Auditor-General for Local Governments was created in Nigeria

In 1989, the Office of Auditor-General for Local Governments was created in every State of the Federation and saddled with the responsibility of auditing the accounts of the Local Governments in Nigeria. This was based on the report of the technical committee set up by the Federal Military Government to look into the possibility of improvement in the financial administration of Local Governments throughout the Country. The committee discovered that there was the Auditor-General for the Federation who audited the accounts of the Federal Government and a State Auditor-General who audited the account of the State Government, whereas at the Local Government as third tier of Government there was a vacuum for such position.

The Legal Instruments supporting the creation of Office of Auditor-General for Local Governments in Nigeria

The following instruments provide the legal status to the Office Auditor-General for Local Governments in each State of the Federation:

- The constitution of the Federal Republic of Nigeria Promulgation Decree of 1989 Section 123.

- Implementation Guidelines on the application of the Civil Service Reforms (in the Local Government Service of 1989, Section 13.

- Local Government (Basic Constitutional and Transitional provision) Decree 7 of 1997, part III.

- Section 74 (3) of Federal Government (Basic Constitutional and Transitional provision Decree) contained in the Federal Gazette No 1 Vol. 86 of 6th January, 1999.

- Provision of Section 316 of 1999 Constitution of the Federal Republic of Nigeria.

- Ekiti State Audit Service Commission Law 2021.

The Auditor-General for Local Governments is responsible for conducting financial audits and review of the accounts of all the Local Governments and Local Council Development Areas. The primary objective is to ensure that Local Government entities (LGs and LCDAs) are following applicable laws and regulations while using taxpayers’ funds efficiently and effectively.

What we do

The functions of the State Auditor-General for Local Governments as entrenched in Section 123 and 316 (1) of the constitution of the Federal Republic of Nigeria 1989 and 1999 as amended are as follow:

- Auditing of public Accounts of the Sixteen (16) Local Government councils, their parastatals, Local Government Education Authorities, traditional rulers and Local Council Development Areas (LCDAs) in the State to ensure that Local governments are following proper accounting practices and financial requirements;

- Auditing of Local Government fund that is domiciled in any Government Establishment, for the purpose of forming an opinion on whether the statements of accounts submitted give a true and fair view of the state of affairs of the Local Governments and compliance with extant rules;

- Conducting performance Audit on Local Governments to determine and ensure effectiveness, efficiency and economy of such Local Governments;

- Ensuring that all revenue accruing to the Local Governments and their Parastatals are accounted for and well expended;

- Evaluating government programmes and services to determine whether they are achieving their intended objectives and whether they are provided in the most cost effective manner possible;

- Ensuring that all necessary books of accounts are kept and maintained as required;

- Submission of timely reports on audited accounts to the State House of Assembly for the consideration of Public Accounts Committee (PAC) of the State House of Assembly;

- Investigating allegations of fraud, waste and abuse in local government/LCDAs and programmes and recommend actions to prevent future occurrences;

- Providing recommendations for improvements in government operations, policies and procedures.

- Our ultimate goal as Local Government Auditors is to provide independent and objective assurances to Local Government officials, taxpayers, other stakeholders that the LGs and LCDAs operate in a transparent, accountable and ethical manner.

Our independence

Our Independence from the LGs and LGAs we audit ensures that our work is objective based and unbiased. This is assured through confirmation of the appointment of the Auditor-General by the State House of Assembly and the enactment of Ekiti State Audit Law No 3 of 2021 to guarantee both operational and financial autonomy of office of Auditor-General for Local Governments. Independence is a critical aspect of the role of the Auditor-General for Local Governments.

We are responsible for conducting audits in a manner free from any influence that could compromise or impair the integrity of our work as Local Governments Auditors.

Mission

(Our mission enunciates our current role and describes our works or jobs)

To offer top-notch auditing services to our stakeholders so as to engender confidence that public funds are being utilized for the welfare and advancement of the populace.

Vision

(Our Vision represents what we aspire to become)

To offer a dynamic audit institution that supports accountability, openness, and responsible use of public resources, with a staff of highly motivated, ethical, competent, and efficient individuals whose actions and results are in line with international best practices for good governance.

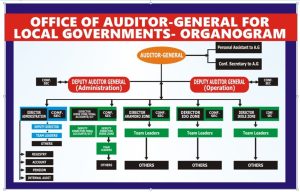

Operational Departments/Units and Area of Coverage

The duties and responsibilities of the Auditor-General for Local Governments span all the Local Government Areas(LGAs) and Local Council Development Areas (LCDAs). The office is therefore structured to operate five specialized departments and each department is headed by a Director. These departments are as listed below:

Ikere Zone: The Auditing of the accounts of all Local Governments and LCDAs that fall under the purview of Ikere Zone which are Ado LG, Ikere LG, Ise/OrunLG, Emure LG, Ado Central LCDA, Ado North LCDA, Ado West LCDA and IKere West LCDA. Other functions of the Departments include:

- Consolidation of the accounts of the Sixteen (16) LGs Annual Financial Statements as prepared by each Local Governments of the State;

- Verification of the accuracy of revenue records;

- Comments on the annual accounts of all LGs/LCDAs and auditor’s report thereon;

- Production of Statutory Audit Reports; and

- Post-audit follow-up actions.

Aramoko Zone: Auditing of the accounts of all Local Governments and LCDAs that fall under the purview of Aramoko Zone which are Efon LG, Ekiti West LG, Ekiti South West LG, Irepodun/Ifelodun LG, Araromi LCDA, Ekameta LCDA, Ifedara LCDA, Igbara-Odo/Ogotun LCDA and Okemesi/Ido-Ile LCDA.

Ido Zone: Auditing of the accounts of all Local Governments and LCDAs that fall under the purview of Ido Zone which are Ido/Osi LG, Ijero LG, Ilejemeje LG, Moba LG, Ero LCDA, Eso-Obe LCDA, Irede LCDA, Irewolede LCDA and Isokan LCDA.

Ikole Zone: Auditing of the accounts of all Local Governments and LCDAs that fall under the purview of Aiyekire LG, Ekiti East LG, Ikole LG, Oye LG, Ajoni LCDA, Ayede LCDA, Ekiti South East LCDA, Gbonyin LCDA, Ifeloju LCDA, Ifesowapo LCDA, Ikole West LCDA and Kajola LCDA.

General Administration and Local Governments Agencies: This department takes charge of the headquarters and general administration of the office including field organizations. It coordinates personnel matters including promotion, advancement, discipline, industrial relations and man power development. In addition, this department ensures proper auditing of the accounts of government parastatals such as LG Service Commission, LG Loans Board, LG PTAD, Institute of Local Government Studies and JAAC Accounts.

NOTE: Each of the departments enumerated above monitors and evaluates government projects, contracts and investments that fall under their purview. It conducts performance audit on projects, policies and programmes of government executed by Local Governments/Local Council Development Arears and carries out any other duty as may be assigned by the Auditor- General. This activity is centered on value for money audit.

Other departments in the office include:

Finance and Accounts Unit

This department keeps and maintains books of accounts of the office of Auditor-General for Local Governments. It relates with the State Treasury office and other relevant government MDAs on finance and accounts matters. Also, the receipt and disbursement of funds on behalf of the office, and preparation of staff salary including annual appropriation accounts are part of its roles.

Registry Unit

The activities involved in the registry of the Office of Auditor-General for Local Governments, Ekiti State are:

- Receiving and recording incoming correspondences, documents, and reports related to the audit of Local Governments;

- Receiving and dispatching of correspondences, and documents related to MDAs in the State;

- Sorting and filing documents in an organized manner for easy retrieval and reference;

- Maintaining a registry system to track the status of documents and correspondences;

- Distributing documents to the appropriate staff members for review and action;

- Assisting in the preparation of audit reports and other official documents;

- Responding to inquiries from internal and external stakeholders regarding the status of documents and reports;

- Ensuring compliance with record-keeping, filing and procedures;

- Collaborating with other departments or agencies to coordinate and facilitate the flow of information and documents among the staff;

- Providing administrative support to Auditors and other members of staff as required;

- Participating in training and professional development activities to enhance skills and knowledge related to registry management amongothers.

Pension Unit

The activities involved in the Pension Department of the Office of Auditor-General for Local Governments, Ekiti State are:

- Vetting and approving pension and gratuity files prepared by the Local Government PTAD to ensure timely payments to the pensioners;

- Maintaining accurate records of all primary school and Local Government retirees in the state;

- Verifying the eligibility of pensioners and ensuring compliance with pension regulations;

- Conducting audits of pension and gratuity funds to ensure transparency and accountability;

- Investigating any discrepancies or irregularities in pension payments;

- Providing assistance and support to pensioners with any inquiries or concerns regarding their pension benefits;

- Collaborating with the Local Government PTAD to ensure seamless coordination and communication regarding pension matters;

- Implementing policies and procedures to safeguard pension funds and prevent fraud or misuse among others.

Progress report of activities of Pension Unit for the month of January to December, 2023.

As a matter of policy, all pensioners’ files are treated with dispatch and no file of a pensioner is allowed to stay longer than 48 hours with the desk officer, no matter the number of pending file

Monitoring of Internal Audit operations in the Local Governments:

The Office received quarterly Internally Audited Report from all the Local Governments during the year under review. The reports were perused and issues highlighted were addressed in the course of planned audit inspection.

How we work

As Local Government Auditors, we work in teams to conduct audit of all the Local Governments, its parastatals and LCDAs. Our work typically involves the following key steps.

Planning: We begin by planning the audit, which involves identifying the scope and objectives of the audit as well as determining the resources and timeline required to complete the audit.

Fieldwork: We conduct fieldwork, which typically involves gathering data and evidence through interviews, document review; and other methods to assess the LGs and LCDAs financial management and operation.

Analysis: Once we have collected all necessary information, we analyze the data to identify any issues, risks or areas of concern.

Reporting: We then prepare a written audit report that summarizes our findings, conclusion and recommendations based on our analysis. The reports being distributed to the audited LGs and LCDAs including Local Government officials and other stakeholders.

Follow-up: Finally, we may follow up with LGs and LCDAs to ensure that they have taken appropriate action to address the issues identified in the audit reports.

Throughout this process, we work closely with each other and with the LGs/LCDAs being audited to ensure that we have all the needed information to conduct a thorough and accurate audit. We also follow strict Professional Standards (i.e. IPSAS, ISSAIs etc.) and code of ethics to ensure that our work is conducted in an objective, impartial and non-partisan manner.

How we report on our work

Reporting on our work is an important part of our responsibilities as Local Government auditors. We normally issue audit reports that document the findings, conclusion and recommendations resulting from our audit to Ekiti State House of Assembly and the inspection reports to the Chairmen, Heads of Local Government Administration among others.

These reports are typically issued in writing and distributed to the Local Government officials and other stakeholders who are responsible for addressing the issues identified in the audit. The reports are equally made available to the public through the Ekiti State Governments Website or other public information channels. In addition to issuing Auditor General Annual Reports, we also present our findings to the LGs and LCDAs officials (i.e. Accounting officers) through formal presentation or meetings. These presentations may include an overview of the audits purpose and scope, a summary of our findings and recommendations and a discussion on any management responses.

By reporting on our work, we help to promote transparency and accountability in Local Government operations and ensure that all stakeholders are duly informed about the proper use of Local Government’s resources and taxpayer’s funds and the effectiveness of Local Government programmes and services.

The operations of the Office of Auditor-General for Local Governments are underpinned by distinct core values. All staff are required to uphold these values during the conduct of their duties. Our Core Values are as dictated by the umbrella Professional International Organization of Supreme Audit Institution (INTOSAI). They include:

Integrity: This implies consistent adherence to an ethical code. Integrity can be measured in terms of what is right and just. It requires staff to observe the form, the spirit of auditing and ethical standards. It involves putting the obligations of Office of the Auditor General (OAG) above one’s personal interests, and conducting oneself in a manner that is beyond reproach.

Independence: This means freedom from the audited entity and other outside interest group. This implies that staff should behave in a way that increases or in no way diminishes their independence.

Objectivity and Impartiality: This is the state or quality of being true even outside a subject‘s individual biases, interpretations, feelings, and thoughts. Audit reports should be accurate and objective and they are to act in an impartial and unbiased manner. Also, opinions, conclusions and reports should be based on evidence obtained and assembled in accordance with the auditing standards and other regulations.

Confidentiality and Transparency: To appropriately protect information, balancing this with the need for transparency and accountability. This is an implied form of the contract between the auditor and client. Auditors are under no legal obligation to disclose faults or unlawful acts to anyone other than clients’ management. Where there is a right to disclose, disclosure should be made in pursuit of a public duty or professional obligation.

Professional Behavior:All the staff of the office of Auditor-General for Local Governments have a duty to conduct themselves in a professional manner and strive to achieve the highest standards of behavior and integrity in their work. As auditors, we duty bound to exercise due professional care in conducting and supervising the audit and in preparing related reports. This implies exhibiting competence, skills, good judgement, conduct and behavior. Auditors should know and follow applicable auditing standards, policies, procedures and practices and should avoid any conduct that may discredit the SAI. Likewise, they must possess a good understanding of the Constitutional, legal and institutional principles governing the operations of the audited entities.

Professional Development: It is the responsibility of the office of Auditor-General for Local Governments to ensure that all staff regardless of their levels and expertise are empowered to do their work and are developed to their full potentials. Every staff member has a continuous obligation to update and improve the skills required for the discharge of their professional responsibilities.